Photo by Maksim Tarasov on Unsplash

Photo by Maksim Tarasov on Unsplash Regulatory Developments in the Crypto Space

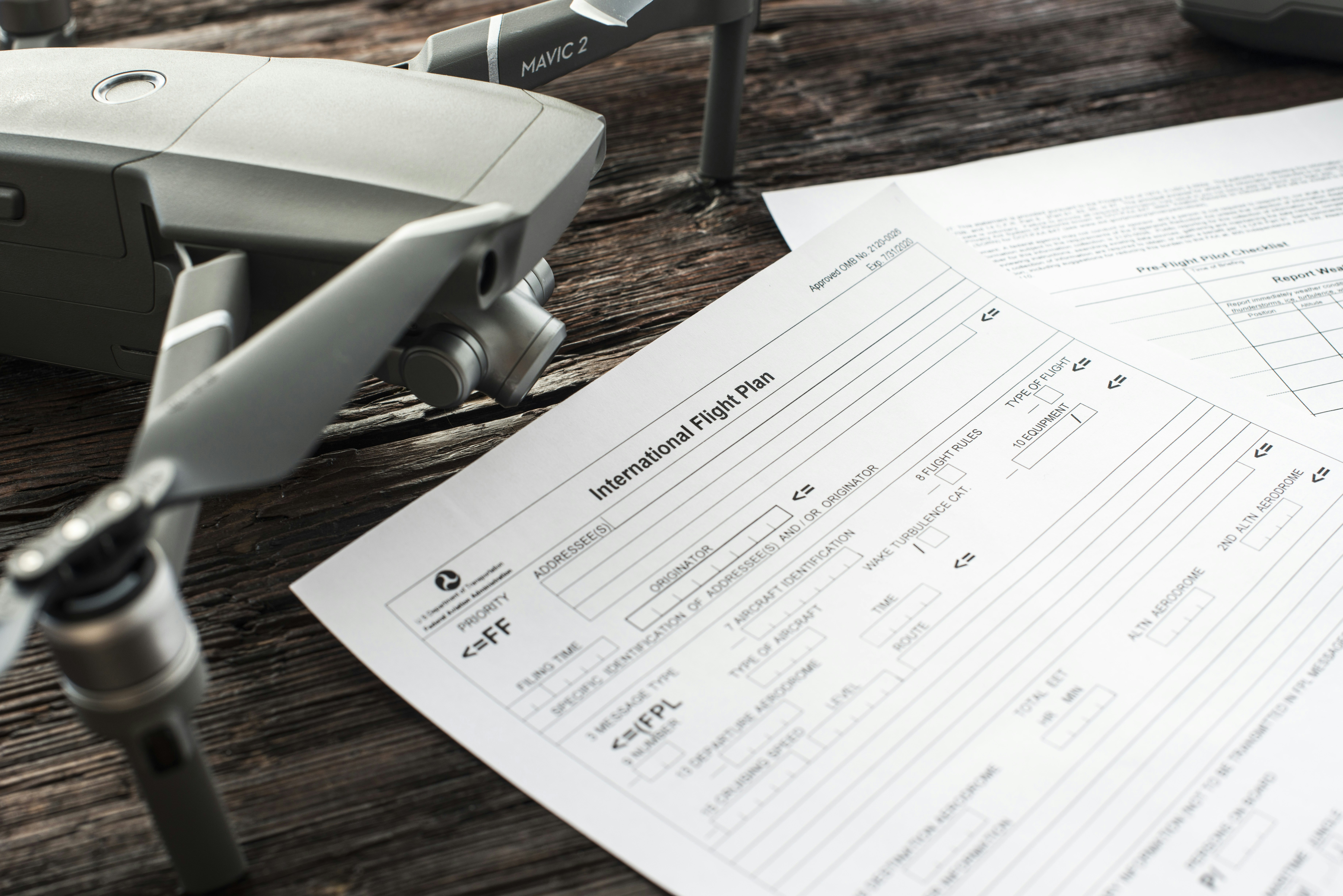

The landscape of cryptocurrency is continuously evolving, significantly influenced by regulatory developments across the globe. As governments and regulatory bodies gain a deeper understanding of blockchain technology and its implications, a series of legislation have emerged that impacts cryptocurrency exchanges, investors, and overall market dynamics. In the United States, for instance, the recent introduction of the Digital Commodities Consumer Protection Act aims to provide a framework for regulating digital commodities, ensuring consumer protection while fostering innovation. This act represents a response to the growing demand for clearer rules governing the buying and selling of cryptocurrencies, aligning with efforts to enhance market integrity.

Meanwhile, in Europe, the European Union has advanced its Markets in Crypto-Assets (MiCA) regulation, which seeks to create a comprehensive regulatory environment for the crypto industry. This legislative initiative not only aims to protect investors from potential risks associated with crypto assets but also strives to support market stability and foster responsible innovation. By establishing clear guidelines on the provision of services related to cryptocurrencies, MiCA could revolutionize the way cryptocurrencies and blockchain technology are integrated into Europe’s financial systems.

In Asia, regulatory responses vary widely, from stringent measures in countries like China, banning all cryptocurrency transactions and mining activities, to more accommodating approaches in nations like Singapore, which has introduced a licensing regime for crypto service providers. These regulatory disparities reflect differing national attitudes toward cryptocurrency, shaping the operational landscape for both domestic and international firms. Stakeholders within the crypto community, including major firms and advocacy groups, have voiced their opinions, emphasizing the need for a balanced approach that safeguards consumers while promoting innovation. Such discussions are critical as they inform policy decisions that will ultimately determine the trajectory of cryptocurrency trading and adoption moving forward.

Emerging Trends and Innovations in Cryptocurrency

The cryptocurrency landscape is rapidly evolving, driven by significant innovations and emerging trends that are reshaping investor strategies and market behavior. One of the most prominent developments has been the rise of decentralized finance (DeFi). DeFi protocols leverage blockchain technology to offer financial services without traditional intermediaries. This shift is enabling users to lend, borrow, and trade assets, thereby increasing accessibility and inclusivity for individuals around the globe. Investment in DeFi projects has surged, reflecting a growing confidence in these decentralized solutions.

Additionally, the explosion of non-fungible tokens (NFTs) has introduced new dynamics to the cryptocurrency market. NFTs, which represent ownership of unique digital assets, have gained traction across various sectors, from art to gaming and beyond. This innovation not only validates the concept of digital ownership but also inspires novel business models that creators and artists are beginning to explore. The demand for NFTs has drawn considerable attention from mainstream media, further solidifying the position of cryptocurrencies as significant player in global markets.

Another wave of change is the continuous advancements in blockchain technology itself. Layer 2 solutions and the introduction of more sophisticated consensus mechanisms aim to bolster scalability and transaction speed, addressing issues that have plagued earlier iterations of blockchain networks. These technologies are enhancing the infrastructure underlying cryptocurrency applications, thereby attracting institutional investors eager for reliable and efficient platforms.

The interplay of these trends—DeFi, NFTs, and blockchain innovations—offers a glimpse into the future of cryptocurrencies. As new projects gain traction and market maturity sets in, understanding these developments will be crucial for investors seeking to navigate the dynamic realm of digital assets. Experts predict that the convergence of these innovations could lead to unprecedented growth in adoption and value creation within the crypto industry.

RELATED POSTS

View all